Unveiling the Possibility: Can People Released From Insolvency Acquire Credit Rating Cards?

Comprehending the Effect of Bankruptcy

Upon filing for insolvency, people are challenged with the considerable effects that penetrate various facets of their financial lives. Insolvency can have an extensive effect on one's credit history rating, making it testing to gain access to credit report or loans in the future. This financial tarnish can remain on credit rating records for numerous years, influencing the person's capacity to secure desirable passion prices or economic chances. Additionally, bankruptcy might cause the loss of possessions, as specific possessions might need to be sold off to repay creditors. The psychological toll of bankruptcy must not be ignored, as individuals might experience sensations of embarassment, anxiety, and regret due to their financial scenario.

Additionally, personal bankruptcy can limit employment possibility, as some companies conduct credit report checks as part of the employing process. This can present a barrier to individuals looking for brand-new job prospects or profession innovations. In general, the effect of insolvency expands past economic restraints, influencing numerous facets of an individual's life.

Variables Influencing Bank Card Authorization

Following personal bankruptcy, people commonly have a reduced credit report score due to the negative impact of the bankruptcy declaring. Credit history card business generally look for a credit score that shows the candidate's capability to take care of credit score properly. By very carefully considering these factors and taking steps to reconstruct credit score post-bankruptcy, people can boost their potential customers of getting a debt card and working in the direction of financial healing.

Actions to Restore Credit Score After Bankruptcy

Rebuilding credit report after bankruptcy calls for a tactical strategy concentrated on financial self-control and constant financial debt administration. The initial action is to assess your credit history report to ensure all debts consisted of in the personal bankruptcy are precisely shown. It is vital to develop a spending plan that focuses on debt settlement and living within your means. One efficient strategy is to obtain a guaranteed charge card, where you transfer a particular amount as security to establish a credit report restriction. Timely settlements on this card can demonstrate responsible credit report use to prospective lending institutions. Additionally, think about ending up being an accredited user on a member of the family's bank card or checking out credit-builder lendings to further increase your credit report. It is essential to make all payments on time, as settlement history substantially influences your credit rating. Perseverance and willpower are crucial as rebuilding credit rating takes some time, but with devotion to appear economic practices, it is feasible to improve your credit reliability post-bankruptcy.

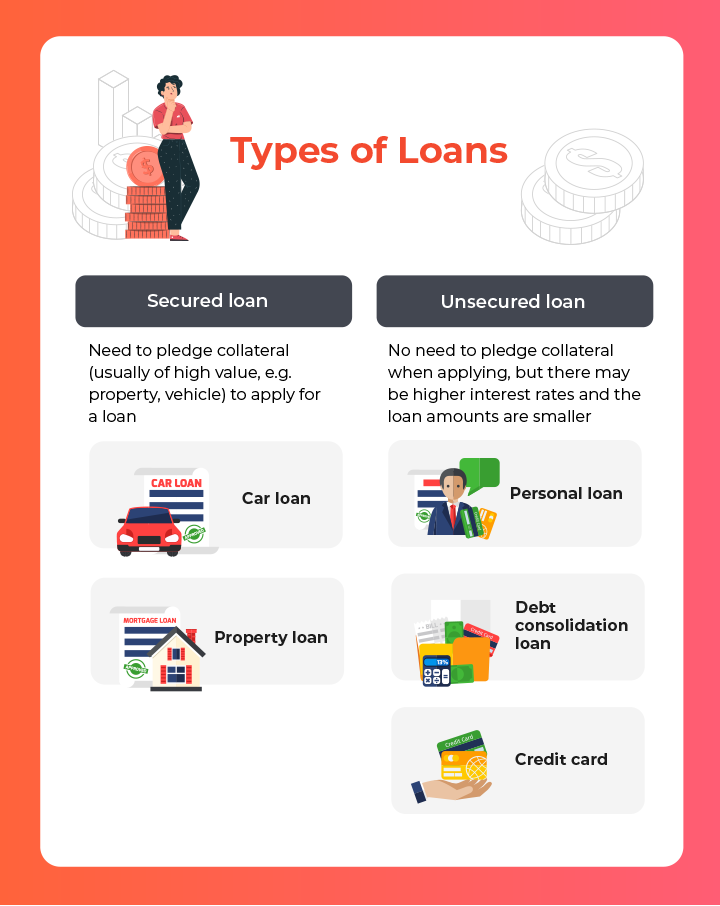

Protected Vs. Unsecured Credit History Cards

Following personal bankruptcy, individuals often consider the option between protected and unprotected Website bank card as they aim to restore their creditworthiness and financial security. Safe credit report cards call for a money down payment that works as collateral, generally equal to the credit line given. These cards are easier to obtain post-bankruptcy given that the deposit reduces the danger for the company. Nonetheless, they may have higher costs and rate of interest compared to unsafe cards. On the various other hand, unsecured bank card do not require a down payment yet are harder to get approved for after insolvency. Companies assess the candidate's credit reliability and might supply reduced fees and passion rates for those with a great economic standing. When choosing in between the two, individuals need to evaluate the article source benefits of less complicated approval with protected cards versus the possible expenses, and think about unsecured cards for their lasting economic objectives, as they can assist restore credit history without locking up funds in a deposit. Inevitably, the choice between protected and unsecured bank card must align with the person's economic objectives and capacity to take care of debt properly.

Resources for Individuals Looking For Debt Reconstructing

For people aiming to boost their credit reliability post-bankruptcy, checking out readily available resources is important to successfully navigating the credit history restoring procedure. secured credit card singapore. One valuable resource for people seeking credit rating rebuilding is credit counseling firms. These organizations offer financial education and learning, budgeting aid, and personalized credit history enhancement plans. By collaborating with a credit counselor, people can gain insights right into their credit scores records, discover approaches to enhance their credit report, and receive guidance on handling their financial resources efficiently.

One more practical source is credit surveillance services. These solutions allow people to keep a close eye on their credit scores records, track any kind of mistakes or modifications, and detect possible indicators of identification theft. By checking their credit on a regular important source basis, individuals can proactively attend to any kind of concerns that might make sure and emerge that their credit history information depends on date and exact.

In addition, online tools and resources such as credit rating simulators, budgeting apps, and economic literacy websites can provide individuals with beneficial details and devices to assist them in their credit history restoring journey. secured credit card singapore. By leveraging these sources efficiently, people released from bankruptcy can take meaningful steps towards enhancing their credit history health and wellness and protecting a far better financial future

Final Thought

To conclude, individuals released from bankruptcy might have the opportunity to acquire credit scores cards by taking actions to restore their credit history. Elements such as credit scores revenue, debt-to-income, and history proportion play a substantial role in charge card approval. By comprehending the impact of bankruptcy, picking between secured and unsafe credit cards, and making use of sources for debt restoring, people can enhance their creditworthiness and possibly acquire accessibility to credit score cards.

By working with a credit score counselor, individuals can obtain understandings into their debt records, learn techniques to improve their credit report ratings, and get guidance on managing their financial resources properly. - secured credit card singapore

Comments on “The Top Features to Look for in a Secured Credit Card Singapore”